Home Insurance Estimate

As a homeowner, it’s very important to have the right home insurance. This protects your biggest investment. The national average cost of home insurance is $2,285 per year for a $300,000 dwelling limit. That’s about $190 per month.

Welcome to cegen.org

Home Insurance Estimate !

The cost can change a lot. This depends on where you live, your home’s features, and how much coverage you need. Bankrate’s research shows home insurance rates have gone up. This is because of inflation, higher construction costs, and more extreme weather.

Knowing what affects your home insurance estimate is key. It helps you get the right coverage at a good price.

Key Takeaways

- The average home insurance coverage amount is usually less than the home’s purchase price. This is because of the property’s value and other factors.

- Contents insurance should match the value of your stuff and how much it would cost to replace it.

- Special items like jewelry might only be covered up to $1,000. You might need separate riders for valuable items.

- Home insurance rates can change. You could save up to $1,000 a year by looking at different insurance providers.

- Homeowners should check and compare home insurance policies at least twice a year. This can lead to big discounts or savings.

Understanding the Importance of Home Insurance Estimates

Protecting your home is key. The right insurance is vital. Getting accurate estimates helps you feel safe and secure.

Why Accurate Estimates Matter

Getting the right insurance is crucial. Being underinsured can hurt your wallet. It might leave you with big bills after a loss.

On the other hand, overestimating can cost too much. You’ll pay more than you need to.

The Risks of Being Underinsured

Being underinsured is risky. You might have to pay a lot for repairs or new things. This includes rebuilding your home and replacing stuff.

Not having the right coverage can hurt your money. It’s like not having a safety net.

NerdWallet says it’s important to check your policy often. This keeps your coverage up to date. It helps protect your home and things inside.

| Key Factors Affecting Home Insurance Estimates | Impact on Premiums |

|---|---|

| Location | Areas with higher risk of natural disasters or crime may have higher premiums. |

| Home Age and Construction | Older homes or those built with less durable materials may have higher premiums. |

| Replacement Cost | Homes with higher rebuild costs will generally have higher premiums. |

| Personal Property Value | Homes with more valuable belongings may require higher personal property coverage, increasing premiums. |

| Deductible | Higher deductibles can lower premiums, while lower deductibles may increase them. |

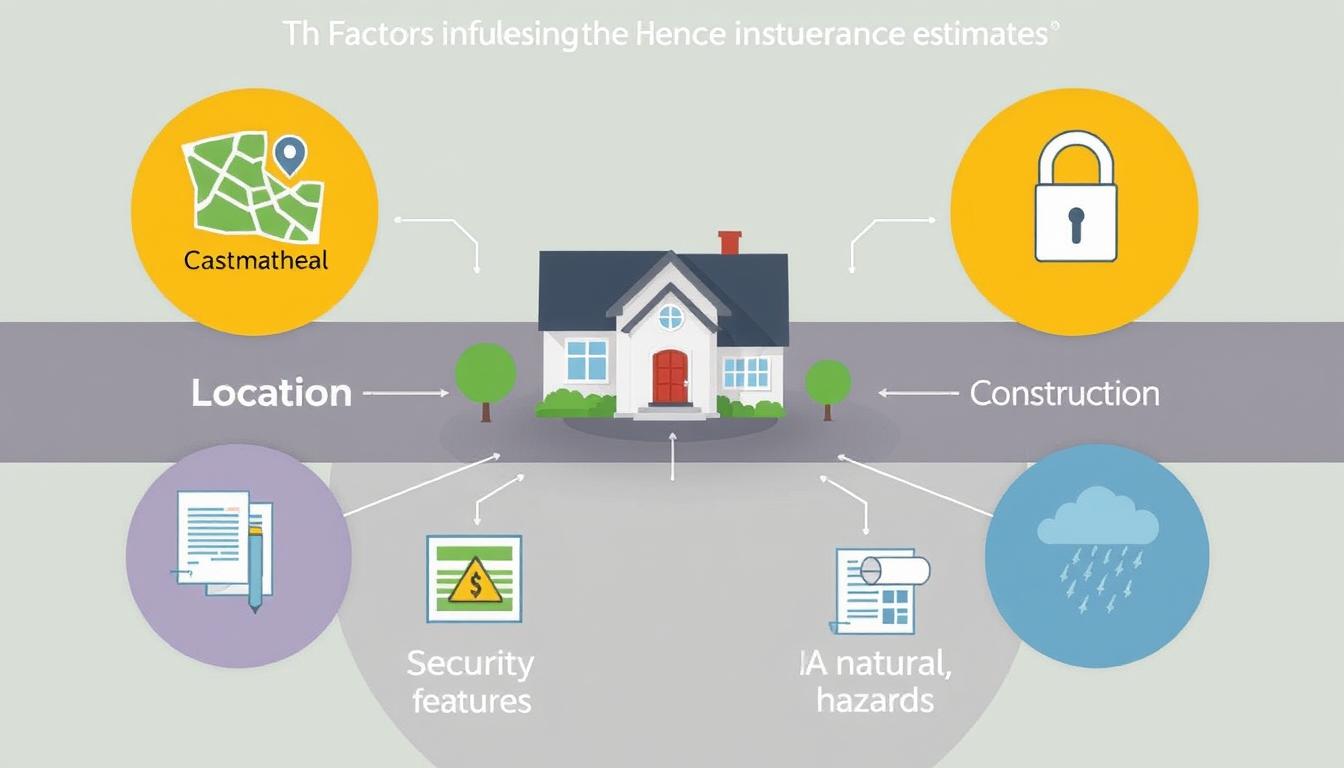

Factors that Influence Your Home Insurance Estimate

Many things affect your home insurance estimate. As a homeowner, knowing these factors is key. They help you understand your insurance cost better.

The location of your home is a big factor. Risks like natural disasters and crime rates can raise your premiums. Areas with more risks or high living costs have higher rates.

The age and construction of your home matter too. Newer homes with safety features cost less to insure. Older homes or those with high-risk features cost more.

Your claims history and credit score also count. Insurers see homeowners with claims or low credit scores as riskier. This can mean higher premiums for you.

The value of your personal belongings and dwelling coverage limits affect your estimate. More valuable items and higher coverage limits can increase costs.

Understanding these factors helps you work with your insurer. You might find ways to lower your premiums. Being informed can help you get good coverage at a better price.

The Role of Location in Home Insurance Estimate

Your home’s location greatly affects your home insurance estimate. Insurers look at risks like natural disasters and crime rates. They also check how close you are to fire departments. Knowing these factors helps you choose the right insurance.

Assessing Risks Based on Geography

Some places in the U.S. have higher home insurance costs. For example, Nebraska, Florida, and Oklahoma are more expensive. But Vermont, Delaware, and New Hampshire are cheaper.

Things like natural disasters and crime rates affect insurance rates. Places prone to tornadoes, hurricanes, or wildfires have higher premiums. Areas with less risk have lower rates.

“Home insurance premiums in Tornado Alley are up to 50% more than the national average.”

Larger cities have higher real estate values. This means repairs cost more, leading to higher insurance premiums. But places with less crime and fewer storms have lower rates.

| Location | Average Annual Home Insurance Cost |

|---|---|

| El Paso, Texas (ZIP code 79925) | $1,626 |

| Honolulu, Hawaii (ZIP code 96818) | $479 |

| Hialeah, Florida (ZIP code 33012) | $5,931 |

Knowing how geographic factors affect insurance rates helps. Homeowners can make better choices. They might even find ways to reduce their premiums.

Home Insurance Estimate: Evaluating Your Home’s Construction

Getting a good home insurance estimate depends on your home’s construction. The age, size, and materials used affect repair or replacement costs. These costs are key for your dwelling coverage.

Insurers look at safety features like fire alarms and security systems. These can lower your insurance costs. Keeping your home’s condition and features up to date is important. This makes sure your coverage fits your home’s current state.

- Average building costs in a specific area can be around $185 per square foot for residential properties.

- Upgraded or energy-efficient utility systems may increase the replacement cost estimate.

- Replacement costs for older homes may be affected by outdated systems and the need for upgrades to match current standards.

National trends in building costs, inflation, and supply chain issues affect your home’s replacement cost. Labor and material costs can be higher in remote areas. This is because it’s hard to get the materials needed.

The size and design of your home also matter. Bigger homes or those with special features cost more to rebuild. This is if there’s a total loss.

Measuring your property and considering upgrades or special features is key. This helps ensure you have enough coverage. It protects your investment and prevents being underinsured.

“Conducting a thorough evaluation of your home’s construction is crucial for obtaining an accurate insurance estimate. This helps ensure you have the right coverage to protect your property in the event of a disaster.”

Calculating the Value of Your Personal Belongings

Your personal belongings are as important as your home when getting home insurance. Insurers usually cover your stuff as a part of your home’s value. They might cover 50% to 70% of your home’s value. It’s key to list all your items, their value, and condition to get the right coverage.

Creating a Comprehensive Inventory

Making a detailed list of your stuff might seem hard. But it’s a big step in figuring out your insurance needs. Here’s how to start:

- Walk through your home and list everything, like furniture, appliances, and clothes.

- Write down the value of each item, or how much it would cost to replace it.

- Take pictures or videos of your valuable items to show their condition.

- Keep your list and photos safe, like in a safe or online.

Having a detailed list helps you know the total value of your stuff. It also makes filing claims easier. The more accurate your list, the more you might get back from your insurance.

| Category | Estimated Cost |

|---|---|

| Furniture | $10,000 – $20,000 |

| Appliances | $3,000 – $5,000 |

| Electronics | $5,000 – $10,000 |

| Jewelry/Watches | $2,000 – $5,000 |

| Clothing | $3,000 – $7,000 |

| Total Estimated Value | $23,000 – $47,000 |

The value of your stuff greatly affects your insurance cost. By making a detailed list, you can get the right coverage for your items. This way, you’ll be protected if something bad happens.

Exploring Additional Coverage Options for home insurance estimate

As a homeowner, it’s key to make sure your home insurance covers everything. Standard policies protect your home and stuff, but you can add more. This makes your home insurance better and stronger.

Think about personal liability insurance. It helps if someone gets hurt at your place or if you damage someone else’s stuff. This coverage keeps your money safe in legal troubles.

Loss of use insurance is another good choice. It helps if your home can’t be lived in because of damage. It pays for places like hotels while your home is fixed.

Umbrella insurance gives you even more protection. It has higher limits than your regular policy. It’s great for people with lots of stuff or who want extra safety.

Looking at these additional home insurance coverages, optional home insurance policies, and supplemental home insurance coverage can help. You can make a home insurance plan that really fits your needs. This keeps your home and money safe.

| Coverage Type | Description | Typical Limits |

|---|---|---|

| Personal Liability | Protects you from liability claims if someone is injured on your property or due to your actions | $100,000 to $500,000 |

| Loss of Use | Covers the cost of temporary living arrangements if your home becomes uninhabitable due to a covered event | 10% to 20% of dwelling coverage limit |

| Umbrella Insurance | Provides an additional layer of liability coverage beyond your standard homeowners insurance policy | $1 million or more |

It’s important to check your home insurance often. Think about these supplemental home insurance coverage options. This way, your home and money stay safe.

Tips for Lowering Your Home Insurance Premiums

Getting the right home insurance is key. But, you can make your premiums cheaper. Simple safety steps can get you discounts and lower costs.

Implementing Safety Measures

Adding safety features to your home is a smart move. Smoke detectors, burglar alarms, and strong roofs can save you money. These features can cut your insurance by at least 5%.

Also, raising your deductible or combining home and auto insurance can save you more. A $2,500 deductible can save you 13% a year. Bundling policies can give you a 5-15% discount.

By using these tips, you can make your insurance fit your budget better. It’s all about finding the right balance.

| Home Safety Feature | Potential Premium Discount |

|---|---|

| Smoke detectors | 5% or more |

| Burglar alarm | 5% or more |

| Storm-resistant roofing | 5% or more |

| Deadbolt locks | 5% or more |

“By implementing safety and security measures, you can often qualify for discounts from your insurer and lower your overall home insurance costs.”

Utilizing Online Home Insurance Estimate Tools

Today, many online home insurance calculators and home insurance estimate tools help figure out your costs. These digital home insurance quote tools let you enter your home’s details and personal info. Then, they give you estimates from different insurers.

Using these online tools is easy. They let you compare options and see what affects your estimate. This helps you make smart choices about your home insurance.

The tool from Coverage.com is easy to use. You just enter your home’s location, size, age, and construction. Plus, your personal info. Then, you get quotes from many insurance companies.

“The average cost of home insurance varies by state and coverage level, influenced by factors such as natural disaster risks, crime rates, and local cost of living and construction.”

These tools also let you look at extra coverage like umbrella policies or flood insurance. This way, you can make sure your home is fully protected. Using these digital tools saves time and helps you make better choices.

Even though these online home insurance calculators and home insurance estimate tools are helpful, don’t forget to talk to a licensed agent. They can help you find the best coverage for your needs and budget.

Conclusion: Securing Peace of Mind with an Accurate Home Insurance Estimate

Getting an accurate home insurance estimate is key. It helps protect my property and assets. I can understand what affects my costs and find the right coverage.

Online tools make it easier to get a good estimate. They help me make smart choices about my insurance.

An accurate estimate is very important. It keeps my money safe in bad times. It also makes me feel secure knowing my home is protected.

By looking closely at my home and exploring options, I can find the best insurance. This way, I can protect my home without spending too much.

Being proactive with my insurance helps me feel secure. I can enjoy my home knowing it’s well-protected. This gives me peace of mind.

FAQ

What is the national average cost of home insurance?

The average cost of home insurance is $2,285 a year. This is for a policy with a $300,000 dwelling limit. It works out to about $190 a month. But, the cost can change a lot. This depends on where you live, your home, and what you need covered.

Why are home insurance rates increasing?

Home insurance rates are going up. This is because of inflation, higher construction costs, and more extreme weather. Bankrate’s research shows this.

What factors influence my home insurance estimate?

Many things can change your home insurance estimate. Your home’s location, how it’s built, its age, and value matter. So does the cost of materials and labor in your area. Your credit and claims history also play a part.

How does my home’s location affect the cost of home insurance?

Where your home is located is very important. Insurers look at the risks in your area. This includes natural disasters, crime, and how close you are to fire departments. All these things can change your premiums.

How do the construction and features of my home impact the insurance estimate?

Your home’s construction and features matter a lot. The age, size, and materials used can affect how much it costs to replace or fix it. Insurers also look at safety features like fire alarms and security systems. These can lower your premiums.

How do my personal belongings factor into the home insurance estimate?

Your personal belongings are also important. Insurers usually cover your belongings as a percentage of your home’s coverage. For example, 50%. It’s key to make a list of your belongings and their value to make sure you’re covered.

What additional coverage options can I consider for my home insurance estimate?

You might want to think about extra coverage options. These can include personal liability, loss of use, and umbrella insurance. These can offer more protection for your assets.

How can I lower my home insurance premiums?

You can lower your premiums by adding safety and security features. Things like smoke detectors, burglar alarms, and storm-resistant roofing can get you discounts. You can also try raising your deductible or getting your home and auto insurance from the same company.

What online tools are available to help me estimate my home insurance costs?

There are many online tools to help you estimate your home insurance costs. For example, Coverage.com has a tool. You can enter your home’s details and personal info to get quotes from different insurers.